Why you NEED CapEx Software

Taking a deep dive into Capital Expenditure Software

What you need to know about CapEx Software

Today, even with all the technology available out there, organizations are still stuck in the past when it comes to their CapEx process. Combing through multiple CapEx budgeting and forecasting spreadsheets, sorting through hundreds of CapEx Request emails and trying to collect data to produce some CapEx reports for analysis. With all these challenges, how can a business grow if they don’t have the information readily available to control their CapEx budgeting and plan for their future?

Take the CAPEX360® TOUR

WHAT ARE THE PROBLEMS WITH A MANUAL CAPEX PROCESS

To start, most organizations (even large multi-billion-dollar businesses) are still relying largely on an email and excel spreadsheet-based system to manage their CapEx which also requires input from multiple stakeholders. This, unfortunately leads to lost time, lost CapEx requests, delays or disruption to CapEx projects, and lack of enough data for review and reporting. In addition, loss of controls leads to more unauthorized capital expenditure resulting in projects not being closed and new projects being opened without approval.

The issues that arise as a result are:

- Inaccurate CapEx budgets and forecasts

- Project delays reducing benefits

- Unauthorized spending

- Inability to deal with the complexity of multi-currency scenarios

- Insufficient reports

- High Error % and poor quality in the business cases

- Inefficiency throughout multiple departments

- Loss of profit

- Low visibility

- Approval bottlenecks

- Inability to manage the Operating Costs (OpEx) associated with Capex projects.

WHAT IS THE CAPEX SOLUTION?

The solution is simple, to reduce costs, improve efficiency and gain a competitive advantage, businesses need CapEx software to streamline all aspects of their CapEx lifecycle from the start of the budgets and forecasting to the completion of a project. Businesses need to automate their CapEx lifecycle in a system that will bridge the gap between information and employees increasing visibility, transparency, standardization in a user-friendly environment.

To implement a CapEx Software that will cover 360 degrees of Capital Expenditure control, the software must handle:

- Multi-year CapEx planning and budgeting

- Budget imports and exports from other systems

- Planned and unplanned carryover

- Multi-currency

- Forecasting with forecasting scenarios

- CapEx forms

- Delegation of Authority

- Segregation of duties.

- Supplemental Requests

- Automatic Approval Request

- Email Approvals

- Mobility

- Auditing and tracking

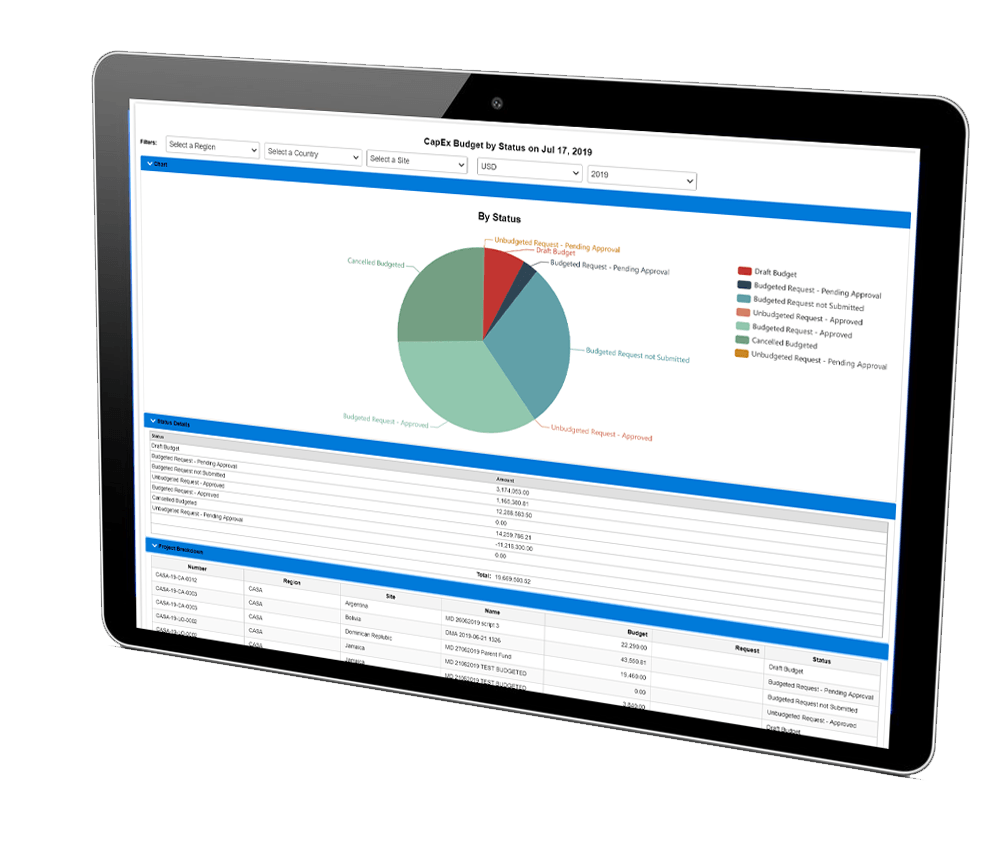

- Reporting

- A great administration module

CapEx Software

The future of CapEx

WHAT IS CAPEX SOFTWARE?

CapEx Software is a solution that allows businesses to automate, streamline, standardize and track all aspects of the CapEx lifecycle from Forecasting and budgeting to CapEx requests and approvals to Project execution and post-investment review, a though CapEx Software should cover it all.

What is the CapEx life cycle?

The CapEx Life cycle is a continuous path of Capital Expenditures. It takes a project from planning, budgeting, executing, post-investment review which is then used a metrics for future planning.

THE BENEFITS OF A CAPEX SOFTWARE

In the real estate industry, it is all about Location, Location, Location. With CapEx software

is all about Control, Control, Control:

• Control over your Capex budget

• Control over your Capex project

• Control over your delegation of authority and Capex approval process.

Getting rid of the spreadsheets and email CapEx requests

to a fully integrated and intuitive CapEx Software would increase efficiency in resources and CapEx execution while giving the business better visibility due to real-time financial metrics allowing for the best portfolio investment decisions. And better data to make better decisions would lead to business success and growth.

Some key improvements to an organizations CapEx

would include:

- Full transparency of the overall CapEx

- Better project planning and financial justifications

- Faster CapEx approvals

- Accountability across sites and regions

- Increased productivity

- Detailed financial and auditing reports

- Accurate up to date data (stop unauthorized spending)

CAN CAPEX SOFTWARE BE USED FOR OPEX TOO?What is the difference between Opex and Capex?

Firstly, let us briefly look at the differences between OpEx vs Capex. OpEx, short for operating expenses, are regular expenses that end up in the expense section of the income statement and are items needed for the day-to-day operation, for example, stationery supplies, cleaning services, or even training.

On the other hand, Capex represents major purchases that have multi-year life spans and if desired, can be resold and such transactions would appear in the balance sheet as company assets. Examples of Capex would be a new truck or new building which get depreciated over their lifespans.

Purchasing a capital asset item is typically a much larger purchase and the project could be multi-phased like the building of a new mine or factory and hence the need for Capex software to manage this type of expenditure.

Now, there is a certain type of OpEx that falls outside the realm of normal operations. These are aptly named Non-Routing Operating expenses. Most companies have an approval process to deal with regular day-to-day OpEx requests but when they are faced with the approval of large Non-Routine Operating Expenses, their process often fails. An example would be approving funds to pay for the settlement of a lawsuit or to approve a large write-down. In both cases, no asset is been purchased but you want to be sure you have the correct approval on the form regardless. For such situations, it is possible to use CapEx software to obtain such approvals for auditing purposes.

CONCLUSION

Capital expenditures are the largest and riskiest accounts in the financial statement. Therefore, an understanding of the importance of CapEx processes and procedures is so critical and can significantly affect the value of a company.

With competition and pressure on margins, companies need to think ahead and automate their CapEx

to grow and stay competitive, because when your CapEx is well managed, your profit margins increase, your projects stay on budget and your business runs smoothly allowing for your focus to be on the business opportunities looking ahead.

See how Caprivi Solutions Covers 360 Degrees of CapEx Control

FIND OUT HOW WE CAN HELP

Caprivi Solutions offers a fully integrated and intuitive CapEx Solution

Get 360 degrees of control

Contact us

Call Us

Feel free to give us a call.

(905)491-6814

Email Us

For general inquiries & questions,

contact us via email

Info@caprivisolutions.com

Visit Us

2275 Upper Middle Rd East, Suite 101 Oakville, Ontario,

Canada

L6H 0C3

View on Map